Willy Woo Predicts Bullish Trend: Is Bitcoin Path to $60K Clear?

Summary

Recent bullish developments in Bitcoin’s market dynamics, influenced by favorable US CPI data and new UK legislation on digital assets, suggest a positive short-term outlook for Bitcoin. Analysts, including Willy Woo, anticipate a potential surge toward the $60,000 mark, despite underlying risks in traditional finance and market correlations. Market indicators reflect a complex environment where cautious optimism prevails as Bitcoin’s liquidity appears to decline, influencing forecasts and investor strategies moving forward.

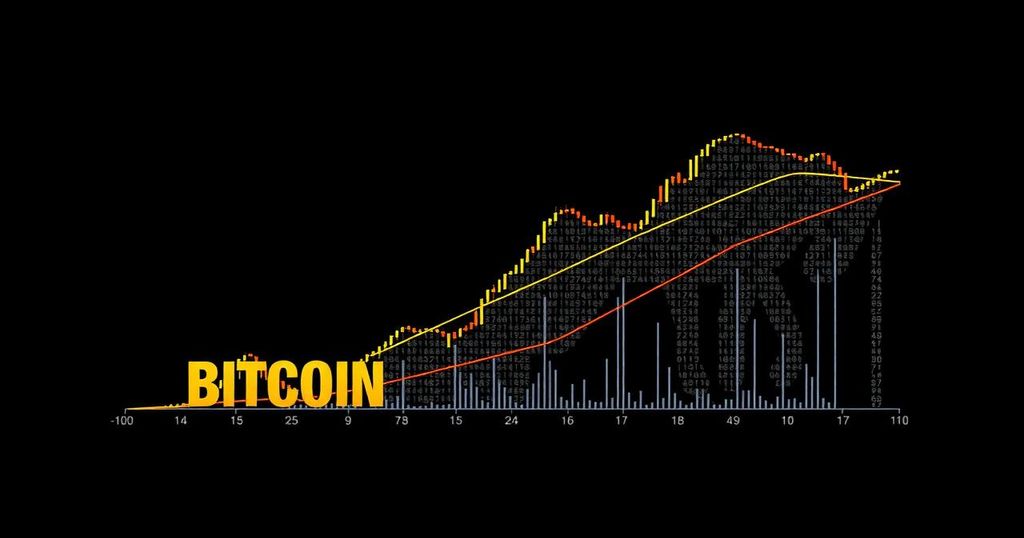

Recent developments point towards a bullish trend for Bitcoin, particularly following optimistic U.S. Consumer Price Index (CPI) data and the establishment of new legislation in the United Kingdom that categorizes digital assets as personal property. Despite these positive signals, certain shifts within traditional financial markets are presenting challenges that may affect Bitcoin’s trajectory. This article evaluates whether Bitcoin has the potential to break the $60,000 barrier amidst these varying forces. Analyzing Bitcoin’s recent price performance, we observe that, following a 6.03% increase in the past week, the cryptocurrency has formed a bullish engulfing candle, indicating strength at both the support trend line and the 50-week Exponential Moving Average (EMA). Moreover, Bitcoin’s weekly returns have demonstrated resilience, showing a remarkable 7.79% increase over the last six days, marked by a series of bullish candles. The price currently faces resistance at the 23.60% Fibonacci level, specifically around $58,655, with a supportive double bottom pattern emerging that could indicate further upward momentum, although a potential death cross could pose a risk on a daily basis. In the four-hour chart analysis, a bullish reversal appears present, having surpassed both the 50-week EMA and relevant local resistance. Nonetheless, the price encounters resistance posed by the 200 EMA and the 38.20% Fibonacci level at approximately $58,314. Signs indicate that this may culminate in a longer-term uptrend, provided that conditions remain favorable as suggested by a forthcoming golden crossover. Amidst these observations, Willy Woo’s insightful commentary brings a nuanced perspective. Woo anticipates a continuation of the bullish momentum in the short term of one to three weeks, yet expresses uncertainty regarding medium-term fluctuations that may delay Bitcoin’s achievement of new all-time highs. Contrarily, the prevailing long-term view suggests we may be in a re-accumulation phase where investors are acquiring Bitcoin at reduced prices ahead of future rallies. Traditional finance faces potential instability as bond rates decrease, which historically correlates with market downturns brought on by external crises. Current on-chain signals also provide insight into Bitcoin’s market liquidity. Data from CryptoQuant indicates a decline in Bitcoin exchange reserves, which presently hover around $2.5 million, suggesting an expectation of forthcoming demand. However, an emerging negative correlation to gold suggests a potential shift in investor focus towards safer assets, indicating risks in the broader financial landscape. Despite this, the forthcoming Federal Open Market Committee (FOMC) meeting and anticipated rate cuts could bolster Bitcoin’s rise above the coveted $60,000 level, particularly targets at the 50% and 61.80% Fibonacci retracement levels of $60,470 and $62,626 respectively. In summary, while the immediate outlook for Bitcoin appears positive with prospects for surpassing the $60,000 threshold, a careful watch over medium- and long-term trends remains prudent as traditional financial indices may influence the market dynamics significantly in the near future. Investors are encouraged to remain informed about upcoming economic indicators and market sentiments to navigate the complexities of the cryptocurrency landscape effectively.

The article discusses recent trends impacting Bitcoin’s price, particularly amidst new legislative frameworks and economic indicators that signal potential growth. It delves into the implications of market performance, the influence of traditional finance on cryptocurrency, and predictions from notable analysts regarding Bitcoin’s pricing strategy. Understanding these elements is crucial for anyone following the cryptocurrency markets, as they reveal both opportunities and challenges amidst a backdrop of economic uncertainty.

In conclusion, the trajectory of Bitcoin is poised to experience bullish tendencies in the short term, bolstered by favorable market conditions and legislative developments. However, caution is advised as traditional financial market fluctuations may pose risks in the medium to long term. The potential for Bitcoin to ascend past the $60,000 threshold is plausible, particularly in light of anticipated economic stimuli, yet investors must remain vigilant in monitoring evolving market dynamics and indicators.

Original Source: coinpedia.org

Post Comment