Bitcoin Price Analysis: Key Challenges at the $60,000 Resistance

Summary

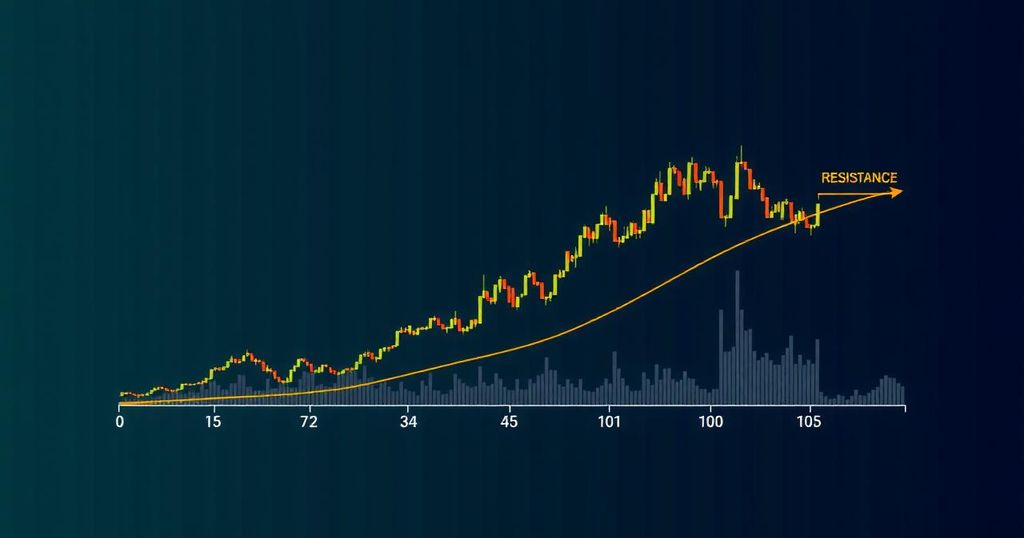

Bitcoin is attempting to rebound from the $53,800 support level, approaching significant resistance at $60,000, compounded by the 50-day simple moving average. Sustaining price levels above these metrics is imperative for bullish momentum, while failures to do so may lead to further declines towards $55,000 and lower.

Bitcoin (BTC) is currently exhibiting a recovery trend from the support level of $53,800. The currency is nearing a significant bearish trend line as it approaches the $60,000 mark on the daily chart. To gain bullish momentum, Bitcoin needs to successfully breach this resistance alongside the 50-day simple moving average denoted in blue. In recent days, the price of Bitcoin has shown positive momentum, bouncing back from a low of $52,756 and regaining the pivotal support level of $53,800. The cryptocurrency surpassed the $55,000 resistance threshold, showcasing a series of daily gains above this level. There has been a notable upward movement exceeding the 23.6% Fibonacci retracement level, which tracks the decline from the recent high of $65,200 to the low of $52,756. Despite this recovery, the price remains significantly below the critical $60,000 level and the 50-day simple moving average. Presently, Bitcoin may extend its gains beyond the resistance level of $58,500, with the next obstacle identified at the 50% Fibonacci retracement level of $59,000. The foremost resistance appears to be forming around the 50-day simple moving average at $60,000, coinciding with the established bearish trend line. For Bitcoin to initiate a substantial upward trend, it must consolidate above these resistance levels. Should it achieve such a breakthrough, bulls could aim for an encounter with the $62,250 resistance zone, with further targets potentially reaching the $65,000 level. If successful at these levels, Bitcoin may experience accelerated growth towards the principal trend line resistance located at $68,000. Furthermore, the recent release of the United States Consumer Price Index (CPI) report for August 2024 indicated an annual inflation rate rise of 2.5%, a reduction from 2.9%. This development could elevate the likelihood of a Federal Reserve rate cut next week, possibly benefiting Bitcoin and other cryptocurrencies like Ethereum. Conversely, if Bitcoin encounters resistance near the $59,000 or $60,000 levels, a decline could ensue. Immediate support levels are found near $56,650, with more significant support located around $55,000. A decline beneath the $55,000 support could precipitate further bearish movements, potentially leading the price down towards the $53,800 support or even the crucial $50,000 level in the near future. In summary, while Bitcoin demonstrates recovery above $55,000, it faces substantial resistance around the $60,000 threshold, which may result in rejection but also presents opportunities for sustained bullish movement should it clear these barriers.

Bitcoin, as a leading cryptocurrency, frequently experiences significant price volatility influenced by market trends, regulatory news, and macroeconomic factors such as inflation rates and interest rate adjustments. These elements contribute to speculative trading behavior among investors. The importance of the $60,000 price level stems from its historical significance as a psychological barrier and a technical resistance zone, providing insight into market sentiment and potential direction for Bitcoin movement. Assessing Bitcoin’s performance around this level is crucial for understanding not only the cryptocurrency’s trajectory but also the broader blockchain market dynamics.

In conclusion, Bitcoin is currently navigating a critical phase as it attempts to recover from lower levels. The upcoming challenges at the $60,000 price point, alongside the 50-day simple moving average, represent key barriers for Bitcoin bulls. The potential for gains remains, contingent upon surpassing these resistance levels, while significant downside risks exist if support levels falter. Investors should closely monitor market conditions influenced by broader economic indicators, including inflation and Federal Reserve policies, to gauge future Bitcoin price movements effectively.

Original Source: coinchapter.com

Post Comment