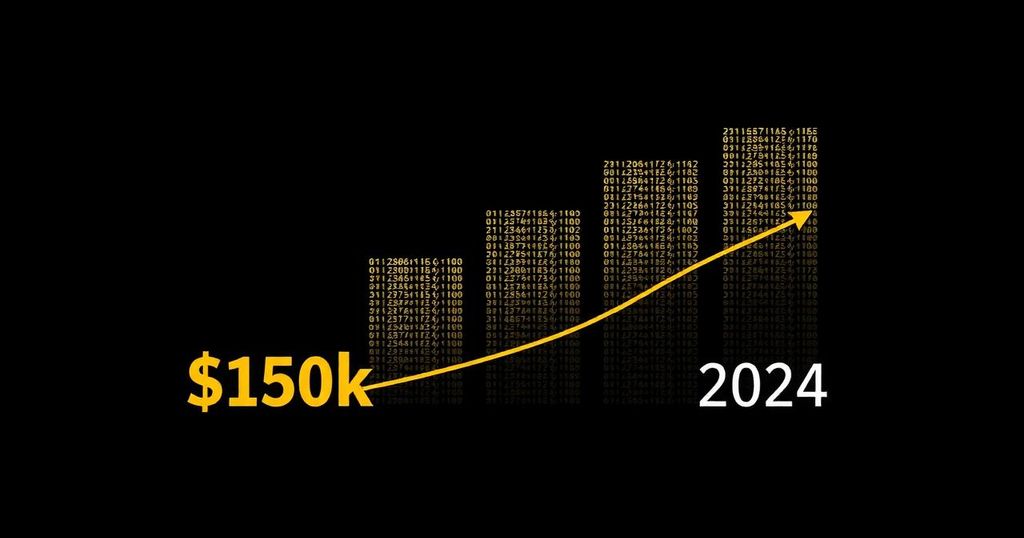

Bitcoin’s Historic Surge: Analyzing the Factors Behind the $150K Milestone in 2024

Summary

In 2024, Bitcoin’s price exceeded $150,000, driven by a surge in institutional investments, global adoption as legal tender, favorable regulatory frameworks, impactful halving events, and macroeconomic factors such as inflation. This milestone has profound implications for the legitimacy of cryptocurrencies, growth in decentralized finance, heightened scrutiny from governments, and advancements toward sustainable mining practices. Bitcoin’s future remains a topic of considerable speculation, with various potential scenarios including increased price growth and deeper integration into the global financial system.

In 2024, the cryptocurrency landscape was profoundly transformed when Bitcoin’s value surpassed $150,000, a historic peak that astonished investors and analysts alike. This significant milestone is attributed to a confluence of factors, ranging from substantial institutional investments, global adoption of Bitcoin as legal tender, favorable regulatory environments, the impactful Bitcoin halving event, and macroeconomic pressures including inflation and a weakening U.S. dollar. This article delves into the dynamics underlying this price surge and assesses its implications for the financial ecosystem and the future of cryptocurrency. The evolution of Bitcoin from an experimental digital currency to a globally recognized financial asset is remarkable. Since its launch in 2009 by Satoshi Nakamoto, Bitcoin has undergone several price milestones, including noteworthy thresholds of $1,000 in 2013, $20,000 in 2017, and $60,000 in 2021. The emergence of Bitcoin as “digital gold” solidified its stature as a hedge against economic instability leading up to its unprecedented valuation in 2024. Five primary catalysts propelled Bitcoin’s price to new heights in 2024: 1. Institutional Investment: The influx of investments from major financial entities, such as BlackRock, Goldman Sachs, and JP Morgan, significantly boosted confidence in Bitcoin as a legitimate asset class. The approval of Bitcoin exchange-traded funds (ETFs) by the U.S. Securities and Exchange Commission (SEC) was pivotal, facilitating access for traditional investors and contributing to a bullish market shift. 2. Global Adoption: The recognition of Bitcoin as legal tender by various nations, notably those experiencing economic turmoil, catalyzed its acceptance on a global scale. Countries like Argentina and Venezuela increasingly turned to Bitcoin amidst hyperinflation, while global corporations, including Tesla and Amazon, began accepting it as a payment method, enhancing its legitimacy and demand. 3. Regulatory Approvals: Progress toward transparent regulatory frameworks facilitated Bitcoin’s growth. The implementation of the MiCA (Markets in Crypto-Assets) Regulation in the European Union, along with comprehensive U.S. crypto laws, endowed investors with needed security and clarity, replacing past uncertainties with a more favorable market environment. 4. Bitcoin Halving Event: The biennial Bitcoin halving event in 2024 reduced the block reward for miners, consequently curbing supply. Historical trends suggested that such halving events typically lead to price escalations, and 2024 proved consistent with this pattern as demand surged amid dwindling supply. 5. Macroeconomic Factors: Global inflation and geopolitical tensions motivated both individuals and institutions to seek alternative assets. Bitcoin’s reputation as a safe-haven commodity reinforced its status as an appealing investment, paralleling discussions surrounding de-dollarization as nations diversified their reserves by holding Bitcoin. The repercussions of Bitcoin’s ascent past the $150,000 threshold extend beyond individual investments; notable effects include: 1. Legitimate Asset Class Recognition: Bitcoin’s success has validated cryptocurrencies as viable competition to traditional assets, sparking the creation of diverse cryptocurrency-based investment products, including ETFs and mutual funds. 2. Enhanced Decentralized Finance (DeFi): The surge in Bitcoin’s value has invigorated DeFi initiatives, encouraging significant liquidity influxes into platforms such as Aave and Uniswap, allowing users to earn yields on Bitcoin holdings. 3. Government Scrutiny: The rapid rise of Bitcoin has drawn increased scrutiny from regulatory bodies concerned about its impact on traditional monetary systems, prompting discussions regarding more stringent regulatory oversight. 4. Environmental Considerations: The environmental implications of Bitcoin mining resurfaced, leading to a demand for sustainable practices and innovations in mining technologies. 5. Effects on Altcoins: The thriving Bitcoin market powered a broader cryptocurrency market rally, elevating prices of other cryptocurrencies as investors pursued diversified portfolios. Looking ahead, several scenarios may evolve in the wake of Bitcoin’s accomplishment: 1. Ongoing Price Growth: Analysts speculate that Bitcoin may continue its trajectory, potentially reaching prices of $250,000 or more, fueled by sustained institutional investment and anticipated technological advancements. 2. Increased Integration: Bitcoin’s assimilation into global financial systems could deepen, with countries potentially incorporating it as a reserve asset. 3. Regulatory Dynamics: The market may face future regulatory shifts, introducing new tax structures or anti-money laundering regulations that could temper growth. 4. Technological Innovations: Development of Layer 2 solutions may enhance Bitcoin’s practicality for everyday use, solidifying its role as a medium of exchange in addition to a store of value. In conclusion, Bitcoin’s phenomenal rise past $150,000 in 2024 marks a significant milestone in its journey, reflecting the cryptocurrency market’s maturation and comforting investors. The interplay of institutional investments, global acceptance, and favorable regulatory signals has not only legitimized Bitcoin but also reshaped the financial landscape, laying the groundwork for its continued evolution in the coming years.

The article discusses Bitcoin’s remarkable price surge to over $150,000 in 2024, detailing the historical context of its growth and significant factors influencing this unprecedented rise. It highlights the cryptocurrency’s path from a niche digital asset to a global financial player, offering insight into the broader implications for cryptocurrencies and the financial system as a whole.

Bitcoin’s achievement beyond the $150,000 mark in 2024 serves as a testament to the cryptocurrency’s growing acceptance and the evolving financial landscape. Comprised of substantial institutional investments, increasing global adoption, favorable regulations, supply dynamics, and macroeconomic trends, this surge signifies a new era for Bitcoin and cryptocurrencies at large. The future may hold further growth and integration into mainstream finance, even as the cryptocurrency landscape navigates regulatory scrutiny and technological developments.

Original Source: blockchainmagazine.net

Post Comment