Bitcoin Surpasses $57,500: Key Levels and Technical Indicators

Summary

Bitcoin has surpassed the $57,500 resistance, currently trading above $57,200 and the 100-hour SMA. It has broken above a short-term declining channel at $56,650, with potential gains if it exceeds $58,500 and $58,800. Major supports are at $57,000 and $56,000, with mixed technical indicator signals reflecting both strengthening bullish momentum and buying pressure.

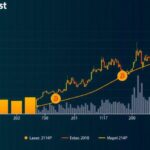

Bitcoin, the largest cryptocurrency by market capitalization, has recently demonstrated significant upward momentum, surpassing a critical resistance level of $57,500. This price action has sparked renewed interest among traders and investors regarding the future trajectory of the cryptocurrency. As of the latest trading activities, Bitcoin is showing a price above $57,200, confirming its position above the 100-hour Simple Moving Average (SMA), which is a technical indicator widely used to assess the overall trend of an asset. A position above the SMA is generally perceived as a bullish sign. In addition to breaching the $57,500 resistance, Bitcoin has broken above a short-term declining channel, with previous resistance noted at approximately $56,650 on the hourly chart for the BTC/USD pair. This breach suggests that buyers have gained momentum, thereby increasing the possibility of further gains. Traders are now focusing on critical resistance levels at $58,500 and $58,800. A successful move past these marks may encourage an influx of new buyers, potentially pushing Bitcoin toward the psychologically significant $60,000 mark. On the downside, major support levels for Bitcoin include the $57,000 mark, which aligns with the 50% Fibonacci retracement level from the recent upward movement between $55,548 and $58,450. Should the price fail to maintain this support, the next zone of significant support is anticipated near $56,000. Technical indicators currently reflect mixed signals; the Moving Average Convergence Divergence (MACD), which indicates momentum, reveals increased strength within the bullish territory, suggesting the possibility of continuing upward momentum in the short term. Furthermore, the Relative Strength Index (RSI) for BTC/USD is positioned above 50, indicating that buying pressure is slightly surpassing selling pressure. In a recent trading session, Bitcoin reached a peak of $58,450 before consolidating some of its gains, and it maintains a position above the 23.6% Fibonacci retracement level of the recent upward move, reinforcing the overall positive short-term trend.

The cryptocurrency market, and particularly Bitcoin, has been the focus of significant attention from both retail and institutional investors. Bitcoin is often viewed as a barometer for the health of the broader cryptocurrency market. Price movements above key resistance levels tend to attract more investors and traders, indicating a potential bullish trend. Technical indicators such as the SMA, MACD, and RSI are frequently employed by traders to assess market conditions and assist in making informed decisions regarding entries and exits in trading positions.

In summary, Bitcoin’s recent price action indicates a strong potential for continued upward momentum following its successful breach of the $57,500 resistance level. The current favorable technical indicators, along with established support levels, suggest a cautiously optimistic outlook in the near term as market participants remain vigilant for price movements above the critical resistance of $58,500 and $58,800. The presence of strong support around $57,000 and $56,000 further underlines the consolidation phase that Bitcoin is undergoing, potentially setting the stage for significant price developments in the upcoming trading sessions.

Original Source: moneycheck.com

Post Comment