First Mover Americas: Bitcoin’s Decline Below $56.5K Amid Political Uncertainty

Summary

On September 11, 2024, Bitcoin dipped below $56,500, influenced by political developments from the Harris-Trump debate. BTC recovered briefly but ultimately settled around $56,497, down 1.1% over 24 hours. The broader digital market also declined, while the Japanese yen strengthened, signaling a move away from riskier assets. Mining profitability declined significantly, posing challenges for miners as Bitcoin’s price persists below $60,000.

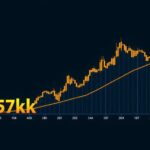

On September 11, 2024, Bitcoin experienced a decline, dropping below $56,500 amid a broader pullback in risk-affine investments. Following a presidential debate in which Vice President Kamala Harris was perceived to outshine former President Donald Trump, Bitcoin briefly hovered over $56,500 before settling at approximately $56,497, reflecting a 1.1% decrease over the preceding 24 hours. The digital asset market also mirrored this downturn, with the CoinDesk 20 Index registering a 1% drop. Concurrently, the Japanese yen demonstrated strength, trading at 140.70 per U.S. dollar, indicating a shift away from more volatile assets. In the debate context, although Harris was viewed favorably in prediction markets, crypto topics were left untouched. Both candidates maintain similar odds in Polymarket contracts concerning the election outcome, although Harris’s probabilities improved slightly during the debate. Harris challenged Trump’s economic record, noting his contribution to a significant trade deficit. Moreover, the economic landscape for Bitcoin mining has worsened; according to investment bank Jefferies, miners saw a decline in average daily revenue per exahash of 11.8% month-over-month, attributing this to Bitcoin’s price decline and an increase in the network hashrate of approximately 2.7%. Despite favorable operational uptime conditions, the ongoing struggle in profitability persists, with Jefferies’ analysts warning that September could prove another challenging month as Bitcoin prices linger beneath the $60,000 threshold. A notable observation is the current state of investor sentiment within the options market, as shown by a chart depicting the distribution of open interest in Bitcoin options on Deribit. A significant concentration exists in call options at higher price points, particularly around $100,000, indicating persistent bullish sentiment despite the recent price fluctuations.

The cryptocurrency market is sensitive to broader economic indicators and political events, frequently moving in response to public sentiment and macroeconomic developments. On the date in question, Bitcoin’s price dynamics revealed a correlation between electoral activities, such as presidential debates, and market behaviors. The unpredictability stemming from political campaigns often impacts investor confidence in various asset classes, including cryptocurrencies. Additionally, the profitability of Bitcoin mining is significantly influenced by fluctuations in Bitcoin value and changes in network hashrate, making it essential for miners to continuously adapt to market conditions.

In conclusion, Bitcoin’s dip below $56,500 reflects a wider trend of risk aversion among investors, influenced by political developments and economic performance indicators. The cryptocurrency market is navigating a period of uncertainty, particularly for miners facing reduced profitability. Meanwhile, despite price challenges, bullish investor sentiment remains evident in the options market, suggesting that many participants still harbor optimistic outlooks regarding Bitcoin’s potential recovery and long-term value.

Original Source: www.coindesk.com

Post Comment