Analyzing Bitcoin’s Potential Breakout Towards $65,000 Amid Negative Funding Rates

Summary

The Bitcoin Funding Rate has turned negative, indicating a cautious market sentiment among traders, which historically precedes significant price increases. Bitcoin is testing a resistance level at $58,000, with potential upward movement toward $65,000 if the breakout occurs. The involvement of top traders and new whale interest further supports this bullish outlook for Bitcoin’s price trajectory.

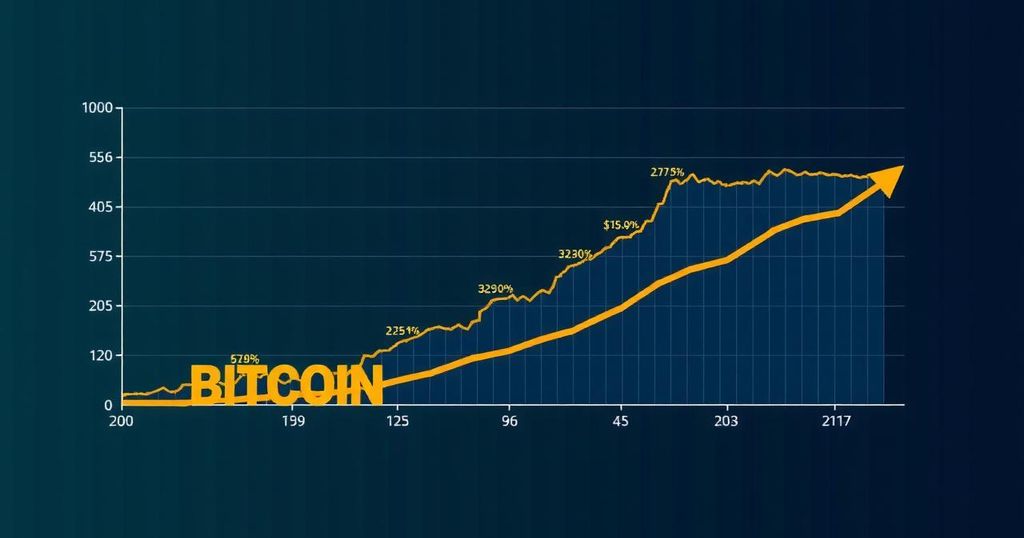

As of the latest analysis, the Bitcoin Funding Rate has turned negative, which may be indicative of a pivotal market reversal. This downturn suggests that traders are displaying increased caution, with current long/short positions reflecting a ratio of 1.61. The futures market is exhibiting a significant selling pressure, evidenced by a Cumulative Volume Delta (CVD) of -1.91 billion. Historically, a negative Funding Rate has often been associated with market bottoming behaviors. Since 2018, K33 Research has noted that when the 30-day average Funding Rates turn negative, Bitcoin typically experiences an average 90-day return of 79%. Negative Funding Rates are often precursors to short squeezes, with heightened buying activity leading to price rebounds. Currently, Bitcoin seems to be approaching a crucial resistance level around $58,000, and if it successfully breaks above this threshold, it may be poised to reach $65,000. The previous historical tendency indicates that negative Funding Rates can precede significant rallies, and the recent price action supports this narrative. However, should Bitcoin fail to surpass the $58,000 resistance, a retraction to lower liquidity levels, possibly as far down as $50,000, could occur. In an analysis of trading behaviors, it has been observed that leading traders on platforms such as Binance have shifted their positions towards long holdings, which reflects an underlying confidence regarding Bitcoin’s ascending price trajectory. These traders, often referred to as “smart money,” are positioning themselves for potential gains amid widespread market apprehensions. Additionally, the aggressive accumulation by new Bitcoin whales—entities that have significantly increased their holdings—highlights a robust bullish sentiment in the current cycle. The whale activity in 2024 has surged, multiplying their investments by 150 times compared to 2020 during a prior bull market cycle, signaling stronger market adoption. Moreover, Bitcoin’s Estimated Leverage Ratio has reached an unprecedented peak in the current year, showcasing an uptick in investor engagement within the derivatives marketplace. This increase in leverage enhances the likelihood of substantial price movements, which may foster an upward trend in Bitcoin’s valuation in the forthcoming periods. In summary, combining these key indicators and market sentiments suggests that Bitcoin is well-positioned for potential price increases, with the key levels of $58,000 and $65,000 serving as critical benchmarks in the immediate future.

The discussion surrounding the Bitcoin Funding Rate stems from its significant implications for market sentiment and price movements within the cryptocurrency sector. The Funding Rate—a mechanism in cryptocurrency futures trading—serves as a critical indicator of traders’ confidence in price direction. Negative Funding Rates imply that there is a prevailing bearish sentiment among traders, which often correlates with market corrections or potential reversals. Historical data illustrates that periods of negative Funding Rates have frequently preceded substantial gains in Bitcoin’s price, making these indications particularly noteworthy for analysts and investors alike. Furthermore, the dynamic activities of prominent traders and whales in the market contribute to the broader understanding of price trends and investor behavior.

In conclusion, the recent shift in the Bitcoin Funding Rate to a negative stance suggests caution among traders while simultaneously laying the groundwork for a possible bullish reversal. Key technical levels, the activity of leading traders, and the newly emerging whale interests all contribute to a compelling case for a potential price breakout towards $65,000, contingent upon sustained momentum above the $58,000 resistance. The current market landscape indicates a blend of optimism with cautious considerations, placing Bitcoin in a unique position to capitalize on forthcoming opportunities within the cryptocurrency ecosystem.

Original Source: ambcrypto.com

Post Comment